August 2024 FP&A Roundup

The best FP&A content in August.

Read this post and join the discussion in Plan Buddies - the #1 community for FP&A professionals.

One Big Insight

My favorite quote with some added commentary from yours truly.

CJ Gustafson

From his podcast, Run the Numbers (emphasis added).

The career advice I would give is to be very aware of what you're good at and what you're drawn to.

It was very obvious in college that my strength was writing and telling stories, and I didn't lean into that. I did write for the school newspaper. I did do some stupid blogging stuff online, but I didn't make that the main thing. I didn't think it was a real road to take.

Now I'm looking at it like why did it take me over 10 years after college to realize that I had this ability to stack my skills on. Maybe you're a B+ in one area, but you love to write and you're pretty good at that. Maybe you're an A- there. And you also have somewhat of a sense of humor. If you stack all those three things together, you're creating a category of one.

“Maddie, I just blew my chances of ever getting an interview at [bulge bracket investment bank].” This is what I told my wife after hanging up with a VP at a bank I was trying to network into. He asked me why I wanted to do investment banking, and I gave a generic answer. He pressed harder and asked, “Do you really want to do this?”

About a week before this call, I’d started to have some doubts about my desire to work in investment banking, but I knew to get the interview, I had to convince people that I ate, slept, and breathed DCF models and pitch decks. But for some reason when this VP asked me if I really wanted this, I said, “No. I don’t want to do this. I’m so sorry for wasting your time.” And then hung up.

For me, that was a wake-up call (pun intended). I was pursuing investment banking because I believed it was the best path to becoming a CFO of a tech company. And from a general perspective, it might be. I ultimately decided that there were multiple paths to becoming a CFO, and the FP&A track was more exciting and fulfilling for me personally.

My brother is graduating high school next year, and he asked me for advice on what to study and pursue as a career. Like many people, he could see himself enjoying a career in many different professions.

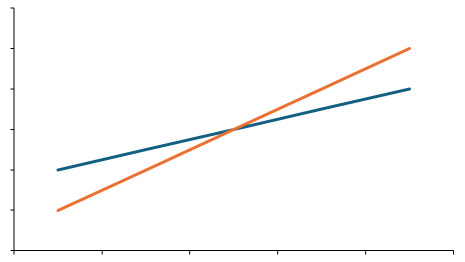

I sent him a picture of this graph:

When it comes to career success, there’s intercept and slope. The blue and orange line represent 2 different career paths.

The blue line starts out ahead of the orange line. In a career, this is determined by how much experience and skill you can prove you have when you enter the workforce. People who know what they want to do early on start out further than those who don’t know exactly what they want to do.

But, the orange line eventually catches up and surpasses the blue line. This is due to a higher career trajectory. Trajectory is determined by how hard you work, how good you are at what you do, and the passion you have for what you’re working on. Anyone - regardless of where they start - can have a super successful career just by having a steep slope.

Obviously, you would ideally have a steep slope and a high starting point, but if you had to choose just one, I would choose slope.

I probably would have been a pretty good investment banker. I have a lot of the analytical skills required to succeed in that field. But I don’t think I would have been a great banker.

I get a lot of fulfillment out of building companies, uncovering insights, and recommending and implementing changes that improve the trajectory of the business. My skills combined with that passion for building is what I believe makes me great at FP&A.

As CJ Gustafson said, finding your unique combination of skills and interests will put you in a category of one, and I believe that will accelerate career growth.

Sound Bites

Great quotes with links to the original source.

Secret CFO

From his newsletter post, Strategic Finance Part I (emphasis added).

A good strategy MUST have two things: where you are going to win, and how you are going to win. Mission, purpose, and values are important too. But only as a means of getting to where and how you will win….

One area where [Finance] is uniquely placed to influence the strategy is on the numbers themselves….

But it’s not the model or output itself that is useful. It’s the modeling process. You will learn things about sensitivities, tensions and pain-points in the strategic plan that otherwise might have been missed….

By coordinating through a central methodology, finance is uniquely placed (normally through the FP&A function) to independently evaluate the impact of strategic options or decisions….

Whenever I see a business that can’t convert its strategy into execution, there is oftentimes a major FP&A failure responsible….

[Finance] needs to have the insight, voice, and influence to flag one of two strategic failings:

The business is failing to deliver the strategy

The business is delivering the strategy, but it is not having the desired effect.

Zach Rial

From Paul Barnhurst’s podcast, FP&A Tomorrow (emphasis added).

Usually you see [athletes] in football. And they are just good at sports. Specifically, they're good at football. But they don't have one set position that's their position, they're not a cornerback or a linebacker; they're just an athlete. And they can fill whatever role is needed for the team.

So a finance athlete, isn’t somebody who does AP or AR or X, Y, Z. It’s somebody who says, ‘I do finance.’ It means [having a mindset of] how can I help the business, how can I make sure that we're doing things that are most important — whether that's traditional FP&A or strategic finance or accounting.

Larry Roseman

From CJ Gustafson’s podcast, Run the Numbers (emphasis added).

People often ask, ‘Are you focused on short term growth or long term growth?’

And really, what you ought to be focused on is value creation.

And how do we how do we create the most the most value?

Theoretically the NPV decision takes into account and discounts medium term and long term investments. So as long as you're investing in the right value creation opportunities, you should be okay.

Now, at the end of the day, we're not sitting there and doing DCF analysis every project. So there is inherent judgment around risk and time to pay back in every decision. But the sort of mindset is not short term growth or long term growth. It's balancing both in order to sort of get the things that are going to create the most value.

Liran Edelist

From Paul Barnhurst’s podcast, FP&A Tomorrow (emphasis added).

I always see the finance as a starting point….I always think about FP&A as secondary to the CEO of the company, helping navigate between different processes and inefficiencies in the organization.

Finance is a starting point, because you need to have budget, you need to have your finance reports in place. But then, if you really want to understand and make an impact, you need to understand what's behind numbers.

Carl Seidman

From his LinkedIn Post (emphasis added).

The best financial leaders aren’t those with the best technical skills. They’re the ones who communicate most effectively. How can you learn how to do that too?

1) Intelligence (IQ)…

Some intelligence is learned while some is innate. When it comes to finance, it’s nearly impossible to elevate in the profession without technical skill.

Once a certain threshold of skill is reached, work focus becomes much about problem-solving, people, and collaboration within groups. We usually call those companies.

2) Emotion (EQ)

Emotional intelligence represents awareness of surrounding environments and personal existence and being able to engage thoughtfully.

Some people have a remarkable ability to stay calm in crisis situations. Others have a unique compassion, understanding verbal tone, body language, and facial expressions. It’s a subtle art….

While IQ alone doesn’t make someone an effective financial communicator, the combination of IQ and EQ can.

But it often needs to go further.

3) Adaptability (AQ)

The best communicators aren’t just smart, likable, and trustworthy. They’re highly adaptable. They can identify risks. They can sense resistance. And they can perceive new opportunities that others may not see.

They’re able to exert influence and bring others around to their positions. They don’t do it through coercion. They do it with executive presence and rapport-building.

4) AQ > EQ > IQ

Jim Cook

From his newsletter post, Leadership Influence and Communications (emphasis added).

My definition of “Financial Influence” = The Ability to Communicate Data into Insights/Wisdom in order to Create, Challenge, and Course Correct Decisions.

Paul Barnhurst

From his LinkedIn Post (emphasis added).

Boss, I have bad news. It's month one, and we have virtually no chance of hitting the plan this year, and it is my fault. 👇

I still vividly remember my first year forecasting revenue for a SaaS business.

I was thrown into the role with virtually no training or guidance, and I messed up the churn forecast. Churn was more than double what we anticipated in month 1, and sales were lower; we never recovered. That was a tough message to deliver to the business, but it taught me a lot.

Regarding forecasting revenue, I have learned two things that are key to building a robust forecast for almost all businesses.

➡Data - You need the right data, and you need clean data, or at least clean enough to guide your thinking and forecasting.

➡ Business Knowledge - Understanding the business allows you to build a model that incorporates the key drivers that impact it. Without business knowledge, it is very hard to get the drivers right.

Brett Knowles

From Jack Sweeney’s podcast, CFO Thought Leader (emphasis added).

The Socratic model of a good debate helps you get a good answer. When we can have diversity of thought around the room and people feel risk-free to communicate their feelings and their observations, naturally better answers come to the surface….

AI is just another voice at the table. And if we don't feel comfortable debating with AI, as we do anyone else around the room, we have a problem. AI is going to present a bunch of ideas no different than each individual presents ideas based on their experience, their perspectives, and so forth. But we need to weigh that against a bunch of other factors, and even more so with AI because it doesn't have that common cultural or business background that is bringing into the conversation.

Memes

Just for fun.