May 2024 FP&A Roundup

The best FP&A content in May.

Welcome to the 1st edition of Marginally Beneficial! We hope you enjoy it!

Read this post and join the discussion in Plan Buddies - the #1 community for FP&A professionals.

One Big Insight

Secret CFO

From his newsletter post: Killer Finance Teams Do These 7 Things (emphasis added).

A finance team that doesn't influence business behavior is a waste of time. A great finance team will be relentless in its challenge of the business.

A continuous enemy of complacency.

Whether that is through the way targets are set, performance is reported, or business reviews are conducted.

But it's also about support. Doing what is needed to support the business to deliver the right answer.

It's easy to be relentlessly dissatisfied. Always looking for more. It's also easy to be unwaveringly helpful.

Doing both at once, in the right balance, is hard. But good finance teams find a way.

Personal anecdote:

It was late in Q3, and I had accepted the business’ fate of missing the board plan. I had just presented our final forecast to the leadership team for the rest of the fiscal year, and it showed a material miss against the budget.

The CEO said to the room, “This isn’t acceptable. We have to hit the board plan. How are we going to make up the difference?”

I responded, “I don’t think it’s possible to hit plan. There isn’t any scenario I can reasonably come up with that closes the gap to plan.”

The CEO looked at me and said:

“Your job isn’t to tell me what’s possible. It’s to tell us the number we need to hit, and it’s our job to find a way.”

- Hardcore CEO

With that fire lit beneath me, I dove back into the model and found the most realistic path back to plan. It required a significant increase in sales over what I originally believed to be possible. I translated that to a single number of incremental new customers we had to acquire outside of what we were currently doing. I came up with five ideas for how this could be done and went back to leadership. This gave the leadership team the challenge and the support needed to go execute and close the gap to plan.

As finance professionals, we’re often challenging either overly-optimistic or overly-conservative assumptions in the business. This tension is necessary to steering the business on the right path. But, the real value we bring is the strategic support to maximize what’s possible. Anyone can shoot down bad assumptions, but being the type of person that supports the business in finding the right answers and executing to them is much more rare.

Working for startups, I’m used to bringing expectations back to earth, but I still get surprised by how much can be done by chronically optimistic, hard-charging startup founders. We didn’t hit plan that year, but we got a whole lot closer than I originally thought we would.

Sound Bites

Brett Hampson

From his newsletter post: The Secret to Driving Action (emphasis original).

After analyzing the results and understanding the direction you want to go, form a strong opinion. This conviction will serve as the backbone of your storyline, ensuring it has a clear and compelling message.

Remember, you already walked in with an idea of which direction you want to go. But now it’s time to double-down and become the champion for the action you want.

This has to be one of the top 3 secret weapons to my finance career: being the one who cares the most.

If you truly care and people sense it, they will believe and follow even when they are unsure.

Be convinced and be confident.

Tucker Marshall

From Jack Sweeney’s podcast, CFO Thought Leader (emphasis added).

I believe that the finance organization has two key responsibilities. One is to be a steward of financial compliance…

[Second], we also have to bring strategic advice and insight in support of our business partners…At the Smucker company, we have direct finance leads to each business…I often refer to them as the navigators within those teams. We also have a corporate FP&A group that partner with [finance leads] to deliver annual financial planning, monthly forecasting, or assessing strategic projects…[Success] all comes down to how those teams partner with the businesses and bring insights together to get a positive return on our investment.

CJ Gustafson

From his newsletter post: Is Your Revenue Durable? (emphasis in original).

Durability revolves around a technology's sustained usage and necessity over an extended period, often despite changes or advancements in the field. It isn't just about subscription models or being a software as a service; it's about technologies becoming so essential and ingrained in operations that they are less likely to be replaced than other parts of an organization.

“Durability is a function of these other qualitative concepts. The dominance, the stickiness, the absolute necessity, and the amount of competition - is there a lot of gravity - system of record to what you are selling”

-Tony Kim, Head of Technology Investments at Blackrock, RTN Pod: Spotify / Apple / Youtube

Here are some technologies and solutions that exemplify durability:

Microsoft Office: Since its inception in the late 1980s, Microsoft Office has become the cornerstone of business operations worldwide. Try as they might, FP&A planning tools are learning to work with it, not around it. Microsoft Office illustrates workflow gravity.

Bloomberg Terminals: Used primarily by finance professionals, Bloomberg terminals offer financial data and analytics tools that are essential for real-time decision-making in markets. Wall Street’s mascot is not the Bull; it’s a Bloomberg terminal. Bloomberg Terminals illustrate account gravity.

Oracle Databases: Oracle's database solutions are known for their robustness, scalability, and security features. Many large enterprises rely on Oracle databases for critical data storage and operations. It’s also a pain in the ass to move your data after it’s been in one place for so long and connected to so many other things. Oracle Databases illustrate data gravity.

These technologies share common traits that contribute to their durability:

Dominance in their fields: They are the de facto standard.

Stickiness: Once implemented, these technologies become embedded into the workflows and systems of an organization, making them hard to replace.

Necessity: They fulfill essential functions that organizations depend on daily.

Limited competition: While there are alternatives, the entrenched nature and comprehensive features of these technologies make switching costly and complex.

The concept of durability in technology is characterized by a product or service becoming almost indispensable due to its utility, integration, and the significant role it plays within its user base.

Tyler Cyphers

From Paul Barnhurst’s podcast, FP&A Tomorrow.

The people that I've seen be very successful [in FP&A]...have a genuine curiosity about the business...Ultimately, it comes down to being able to talk the talk. So you have to be able to communicate on their level and understand that your reports, your analysis, whatever in the context of the business and why it's important to them.

Liran Edelist

From a question in the Plan Buddies community on how to forecast enterprise deals (emphasis in original).

1. Depending on your company size, it combines science (data) and art (knowing your team and processes). THE CRM MUST have all the indications of the sales process to help you predict the timeline. These indicators should include how many sales cycles have passed (POC, Legal, IT approval, etc.) and the probability of winning based on qualifications and competitors. The final timeline and amount can be calculated in a spreadsheet (for small businesses) or in the BI/SPM/EPM tool (happy to provide more details)

2. If you build business logic, remember that some stages (Variable to the timeline) in enterprise deals will always take longer. The "typical suspects" here are IT and Legal, which usually take at least a few weeks (each) with large enterprises.

3. Continuous Improvement: It's important to have the CRO get involved and take responsibility for forecast accuracy (it’s part of his commitment to the board). Some companies offer incentives to sales teams for their forecast accuracy.

4. For multiple enterprise deals, you can make estimations (i.e. probability x amount) to get a high-level number. I suggest not forecasting deals with less than a 20% chance of closing within the coming quarter. With enterprise deals, only at least 80%-90% should be counted in the current quarter (2-3 months).

Chris Reilly

From his LinkedIn post on “7 Lessons Learned Building Financial Models.”

You can't take 4 days to update the model.

Sorry, but the thing has to built well enough that you can get it updated in at most a half-day.

Some of the best models I've worked on take less than 20 minutes.

I get that sometimes you're constrained by data and that's fine.

What I'm really saying here is make sure the file is designed well enough that your update process is fairly automated.

Carl Seidman

From his LinkedIn post on how young FP&A professionals can stand out.

Young FP&As lack the experience of their senior peers. But what they lack in experience they can make up for in:

Preparation, anticipation, communication, and improvisation.

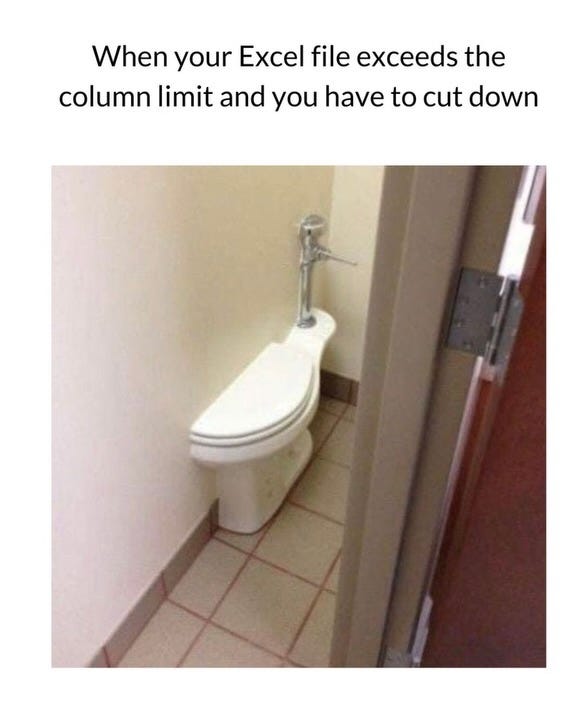

Memes

Carveouts

Upcoming Plan Buddies Events

June 26 - Startup FP&A: The FP&A Cycle in Ever-Evolving Businesses; Hosted by Derek Baker. Link to register.

One More Thing

I’d love your feedback on this newsletter. Send me a reply with your thoughts or answer this poll!